_edited.png)

Ramrajya Sahakari Bank Ltd, Pune

Do’s and Don’ts of ATM Transactions

Do’s and Don’ts of ATM transactions

Do’s

-

Conduct your ATM transactions in complete privacy, never let anyone see you entering your Personal Identification Number (ATM Password)

-

After completion of transaction ensure that welcome screen is displayed on ATM screen

-

Ensure your current mobile number is registered with the bank so that you can get alerts for all your transactions

-

Beware of suspicious movements of people around the ATM or strangers trying to engage you in conversation

-

Look for extra devices attached to the ATMs that looks suspicious

-

Inform the bank if the ATM/Debit card is lost or stolen, immediately, report if any unauthorized transaction

Check the transaction alert SMSs and bank statements regularly -

If cash is not dispensed the ATM does not display “cash out” please report to the Bank on the number mentioned in the Notice Board

-

Immediately check your phone for SMS for debit amount

-

If your debit ATM card lost or stolen, immediately call to bank & block card, for blocking debit card call helpline number -020-24280050, 24282005 or your nearest branch.

-

You can Block your Rupay ATM cum Debit Card through -IMPS application, in case your card is lost or stolen.

Don’ts

-

Do not write your PIN on the card, memories your PIN number

-

Do not take help from strangers or handover your card to anyone for using it

-

Do not disclose your PIN to anyone, including bank employees and family members

-

Do not allow the card to go of your sight when you are making a payment

-

Avoid speaking on the mobile phone while you are transacting

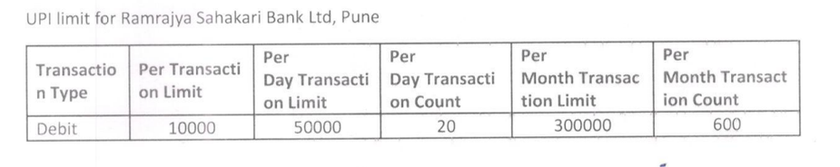

Do’s and Don’ts of UPI Transactions

DOs and DON’Ts when making UPI payments

Dos ‣

Be alert to fraudulent calls (Vishing) that ask you to download third-party apps or share confidential information (disconnect such calls immediately)

‣In case you have already downloaded any remote access app and it is no longer required, uninstall it immediately

‣ Enable app-lock on your payments or mobile banking related apps

‣ Report any suspicious activity at your nearest Bank branch / authorised customer care number only ‣ Validate Transaction Type before transacting, there is one standard rule - NO PIN required for receiving money

‣ Beware of Fraudulent / counterfeit applications, prefer using trusted applications for transacting using UPI

‣ Keep your details updated with your Bank ‣ Alert your Bank immediately in case you experience any unusual transaction

‣ Use ODR (Online Dispute Resolution) for resolving your complaint.- Click Here

DON’Ts

‣ Never share your UPI PIN, CVV & OTP with anyone over Call / SMS / E-mail even if claiming to be from the Bank

‣ Never store Banking passwords in your mobile handset

‣ Be cautious of money requests from unknown senders as accepting a UPI money request iis a debit to your account. Only accept requests from known senders and verified merchants

‣ Do not forward any unsolicited SMS received on a request of the so-called Bank representative

‣ Never give permissions / access to unknown apps

‣ Never open untrusted SMS / E-mails with links redirecting to UPI payment